Closing Bell: The 'time and pressure' of private equity

Having built a rock-solid private equity firm, Peter Collins knows a little something about earth science – which he likens to raising money for a private equity fund.

"Fundraising is like geology," he said. "It's all about time and pressure. It's cold calling. It's going and seeing people. It's about determination, and that's really, at the end of the day, what you get paid for."

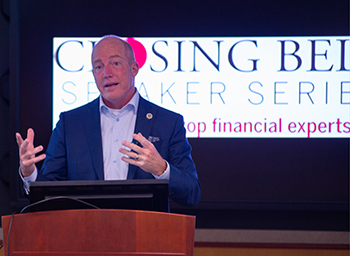

Collins, co-founder and managing principal of Tampa-based Forge Capital Partners, spoke in late January as featured guest in the Closing Bell Speaker Series, a popular College of Business event that gives students exposure to experts in financial economics.

Collins' firm boasts $1.9 billion in transactions over the last 17 years through development of income-producing commercial and multi-family real estate throughout the southeastern U.S. and Puerto Rico.

It makes its money – and money for institutional investors – through sponsorship and management of real estate-oriented private equity funds that invest largely in grocery-anchored shopping centers as far west as Texas and as far north as Virginia.

"We stick with grocery-anchored retail," Collins told students. "And the reason is when the pandemic hit and the shutdown order came, everybody had to shut down, unless the business was a necessity. Well, grocery stores are a necessity."

Take a drive throughout Florida, and you might encounter a Publix as the foundation of a shopping center that one of the firm's private equity funds owns. The funds' holdings throughout the Southeast also feature Winn-Dixie, Kroger, Food Lion and The Fresh Market, among others.

Collins said occupancy rates at his funds' supermarkets haven't dropped below 90 percent during the pandemic, and grocers have maintained growth for years, even during the Great Recession.

"All our tenants were doing better because people weren't going out to eat," Collins said, referring to the peak of the pandemic. "They were going to the grocery store."

During the Closing Bell Speaker Series, he did a TED talk of sorts – explaining to a packed Starry Conference Room the ABCs of private equity and how he launched and followed through on a business idea from two decades ago.

Collins (BS Finance '92; MBA '97), a college Alumni Hall of Fame member and chairman of the Florida State University Board of Trustees, got his start under Ash Williams (BS Management '76; MBA '78), a fellow Alumni Hall of Fame member who served as chief investment officer of the Florida State Board of Administration. Collins worked as a manager at the SBA, which manages and safeguards assets of the massive Florida Retirement System Trust Fund.

"I would see, every day, the top money managers in the country come through the doors, because they were pitching us to invest in their funds," Collins told students. "That's how I learned about the whole private equity fund structure."

The model appealed to him. It would allow him to sell institutional investors on his ideas on buying, developing and selling properties, for which they would get a good return.

"You're selling a story, if you will," he told students. "You're selling a thesis."

His thesis emphasized business opportunities in urban areas that once thrived but had significantly dived.

In the early 1970s, Collins said, residents in Florida and elsewhere began leaving urban areas to escape crowds and crime for better homes and schools, among other things.

He noted a reversal of that trend in the early 2000s. People who soured on suburban life and especially their traffic-congested commutes began to return to urban areas – from where retailers, naturally following residents, had long before abandoned.

"I looked at it as an opportunity," Collins said. "That thesis for me was, 'People are moving back into these urban areas. There's a lot of undervalued properties in these areas, and somebody needs to get a hold of them, understand how to fix these assets or bring them current so that you can do leases with retailers. Then, when you get the retailers in, and you fill up the shopping center, you've got something of value.'"

His funds today invest in grocery-anchored retail anywhere that radiates profit, and they boast two decades of social responsibility, with $400 million of equity invested in commercial retail properties primarily in low- to moderate-income areas.

The economic conditions of the past two years have prompted Forge's funds to be "big-time net sellers," decreasing their assets from 6 million square feet to 4 million square feet in the past year alone.

"We're selling as much as we can bring to market while interest rates are low and capitalization rates are good," Collins told the students.

Collins' presentation prompted questions from students, including one who asked how, in the early days of his firm, he could go to investors and persuade them to invest millions of dollars in his idea and fund. That prompted Collins' comments on time, pressure, cold calling and determination.

He then pointed to Gary Bliss, a senior lecturer who coordinates the speaker series.

"It's like in finance class, or it's like in Dr. Bliss' QMB," Collins said, referring to Quantitative Methods for Business Decisions. "You can't B.S. your way into an 'A' in QMB, and you're not going to B.S. your way into being successful. You have to work really hard at it."

-- Pete Reinwald